federal income tax canada

58 rows For example lets say you made 50000 in employment income and you live in Ontario. Federal Tax Bracket Rates for 2021.

Where Your Tax Dollar Goes Cbc News

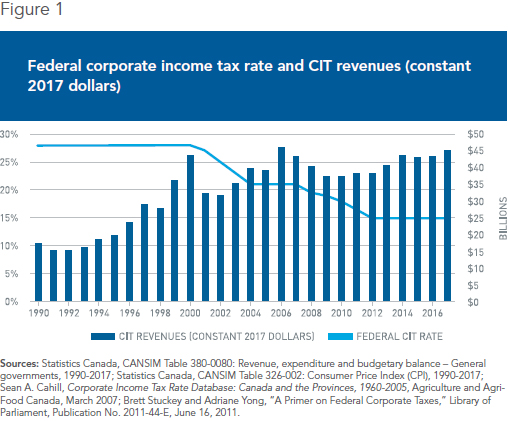

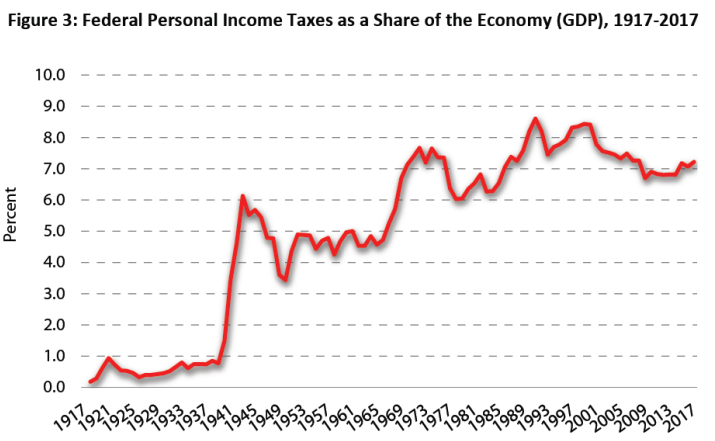

Today approximately one half of the federal government s revenue is derived from personal income tax a significant increase from 26 per cent in 1918.

. Find out about Canada Revenue Agencys new benefits and other changes that support Canadians during the COVID-19 pandemic. The following are the federal tax rates for 2021 according to the Canada Revenue Agency CRA. If your taxable income is less than the 50197 threshold you pay.

10 12 22 24 32 35 and 37. The personal income tax system in Canada is a progressive tax system. In 1938 23 per cent of.

File taxes and get tax information for individuals businesses charities and trusts. Income tax GSTHST Payroll Business number Savings and pension plans Child and family benefits. Personal income taxes are a crucial part of the governments revenue.

Federal income tax brackets span from 10 to 37 for individuals in Canada tax rates are between 15 and 33. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher. IRS Publication 597.

There are seven federal tax brackets for the 2022 tax year. TurboTax free Canada income tax calculator for 2022 quickly estimates your federal and provincial taxes. To pay off debt the government generally needs to increase income which means higher taxes.

Thats in the second tax bracket both federally and provincially. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax. Find out your tax refund or taxes owed plus federal and provincial tax rates.

Your bracket depends on your taxable income and filing status. Canada training credit CTC Line 46900 Eligible educator school supply tax. A document published by the Internal Revenue Service IRS that provides information on the income tax treaty between the United States and Canada.

This guide contains general information needed to complete an income tax return for the 2021 taxation year. Recognising that Quebec collects its own tax federal income tax is reduced by. 15 on the first 49020 of taxable.

Income Tax in Canada vs. 2022 free Canada income tax calculator to quickly estimate your provincial taxes. These are the rates for.

Ad Browse discover thousands of unique brands. Changes to taxes and benefits. Quebec has its own personal tax system which requires a separate calculation of taxable Income.

However in the US singles. Read customer reviews best sellers. How Canadas personal income tax brackets work How much federal tax do I have to pay based on my income.

Income taxes in Canada constitute the majority of the annual revenues of the Government of Canada and of the governments of the Provinces of CanadaIn the fiscal year ending 31 March.

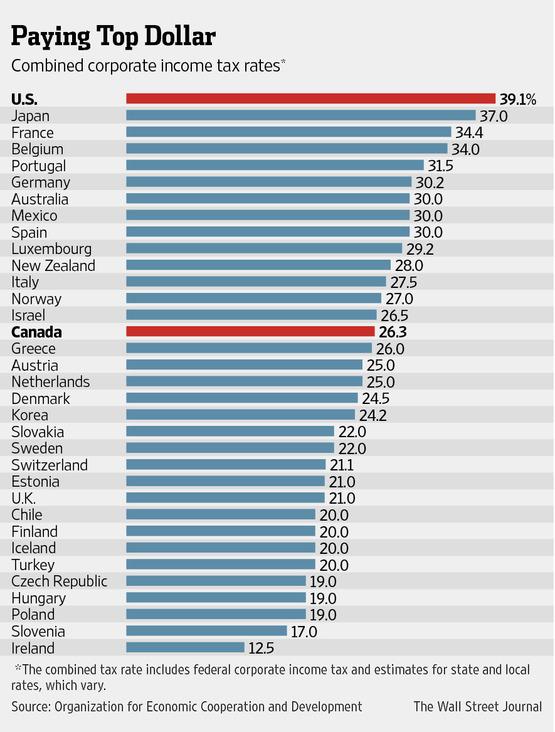

Wsj Graphics Twitterissa U S Has A Combined Corporate Income Tax Rate Of 39 1 Vs Canada With 26 3 Http T Co W4ipbepp8i Http T Co 0ufl444njj Twitter

Federal Income Tax Brackets For Tax Years 2022 And 2023 Smartasset

Tax Time In Canada With It S 3 000 Page Tax Act Rci English

Taxes On 401 K And Ira Distributions In Michigan

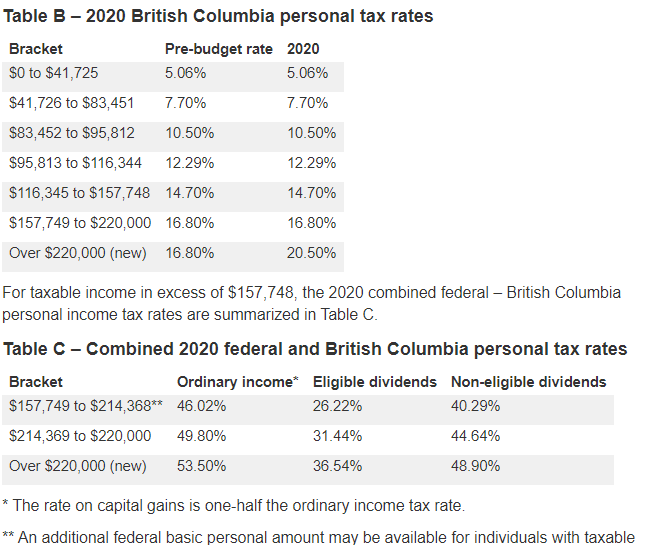

Canada British Columbia Issues Budget 2020 21 Ey Global

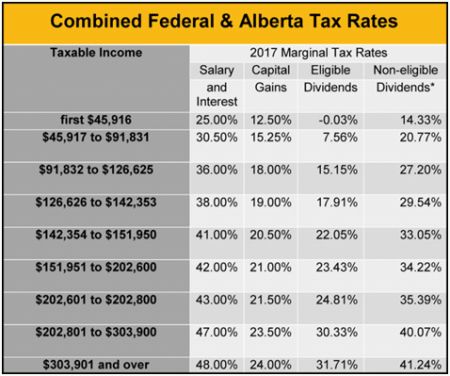

Alberta 2017 Budget Corporate Tax Canada

Canada S Corporate Tax Cut Success A Lesson For Americans Iedm Mei

Thesis The Federal Income Tax In Canada Id Rx913s67b Escholarship Mcgill

Major Changes To Canada S Federal Personal Income Tax 1917 2017 Fraser Institute

Canada S Rising Personal Tax Rates And Falling Tax Competitiveness Fraser Institute

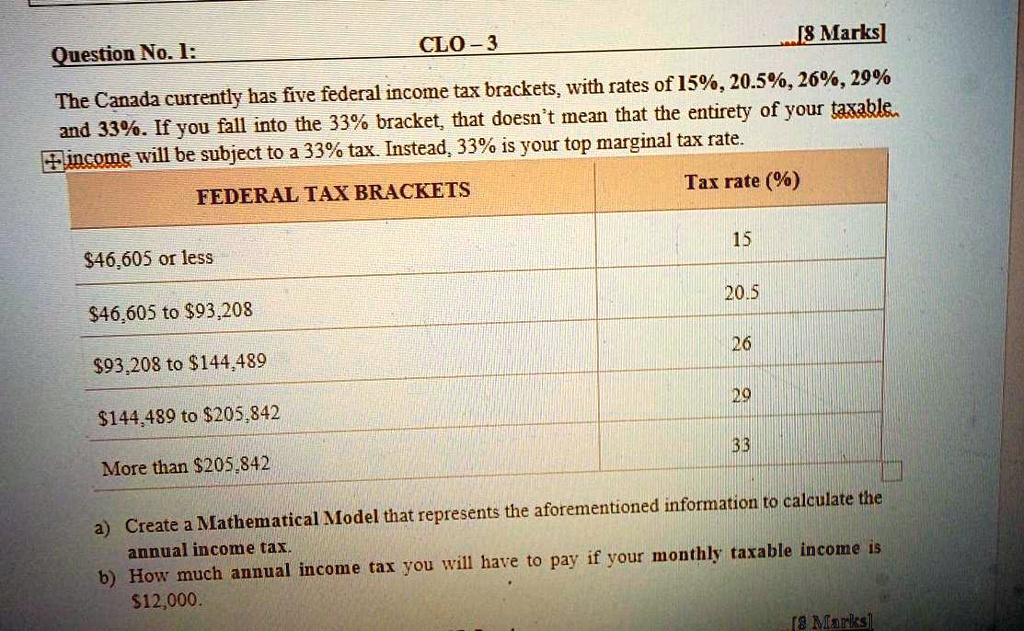

Solved Clo3 8 Marksl Question No Ki Has Five Federal Income Tax Brackets With Rates Of 15 20 5 26 29 The Canada Currently And 33 If You Fall Into The 33 Bracket That Doesu T

Canada Tax Income Taxes In Canada Tax Foundation

Corporate Income Taxes In Canada Revenue Rates And Rationale Hillnotes

Canada S Rising Personal Tax Rates And Falling Tax Competitiveness 2020 The Nelson Daily

Federal Corporate Income Tax Revenues Actual And As A Percentage Of Download Table

Non Resident Alien Graduate Student Canada Tax Treaty Country

Personal Income Tax Brackets Ontario 2020 Md Tax

Income Taxes On The Rich Weren T Much Higher In The 1950s

Top Combined Personal Income Tax Rate In Canadian Provinces In 2016 Infographic Jpg Fraser Institute